Texto en Español: 2013: ¿año de la recesión global?

Translator: Andres Fernando Cardona Ramírez

The world economy is closing one of the worst epochs in its history. Since 2008 there has been no noticeable trend of sustained economic recovery. What began as the real estate debacle of the U.S. (the subprime bubble), became a financial crisis in North America and Europe, which has not allowed the world to leave behind the recession that began in the last quarter of 2007. Five years after the world economic cycle began its downturn, it appears that we will continue moving downhill.

For countries like Colombia, as well as other emerging markets in Latin America and East Asia, which came quickly from the crisis and have had satisfactory performance in the last three years, this information is relevant because the signs show that the deterioration of the economy of the industrialized countries will inevitably slow down the entire planet.

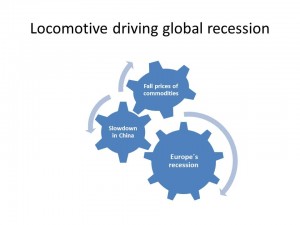

This is the engine that drives us into a global recession:

1. Europe’s stalled recovery. The crisis in Greece, Spain and Italy and the low growth in France has become the priority of economic policy in the Eurozone. Consequently, like an orchestra that responds to the direction of the Germans, these countries are in an adjustment process that seeks to reduce the fiscal deficit and the cost of public debt, which means public spending is reduced, with the usual recessive effects.

While increasing the heterodox speech requires that adjustments be accompanied by expansionary Community policies, such as issuing Eurobonds to face the market that has retained the premium debt of these countries at unacceptable levels, the reality is that the orthodoxy, led by Angela Merkel, continues to gain momentum by imposing an inflexible model of contractionary measures that seek to reduce the deficit at all costs.

2. United States does not sustain its economic recovery. The U.S. economy has shown some positive signs but these are unstable. While the unemployment rate has lowered in this country, and there are indications that Americans are turning less and less to social security to seek help for unemployment, the confidence of consumers and investors is not stable, indicating that economic recovery is not solid in the short term.

Now, the fact that this is an election year and that Obama does not have majorities in both chambers (Senate and House of Representatives), implies that the structural measures that must be implemented are to be delayed until next year. In other words, the U.S. economy needs the gears of growth to be greased, but the political environment does not allow immediate action.

3. The slowdown in China. The engine of global growth, despite the crisis in Europe and North America, has been the Asian colossus. China has achieved sustained growth rates close to 9% during these years, which, accompanied by a greater stability of Latin American and Asian countries, has buoyed the economy in the world. But the fuel is running out for emerging markets. A sustainable global growth is not possible without the participation of countries with the highest income level in the world, the industrialized nations.

The world economy is a system in which Europe, Japan and North America remain the leaders in brand management, innovation, engineering design and management of marketing, but now, large multinational firms have made a “world trade of tasks” , where parts and component production is delegated to the emerging markets and the assembly of industrial goods to China. In this process, India deals with service tasks, especially after sales. But the Chinese market is not growing at the speed required, therefore, as long as Europe and America do not recover, the Chinese locomotive has to cool its engines or there will be an insufficient global market to sell everything that is processed. If not, the overheating of its economy will be inevitable.

4. The fall prices of commodities. Many Latin American countries- mainly Argentina, Colombia, Peru, Ecuador, Bolivia and Venezuela-, have built growth around exports of raw materials. Increased and sustained demand from China and other emerging markets for commodities have ensured a trade surplus in our economies, which has become an engine for attracting foreign investment, mainly focused on the mining sector. But the slowdown of China’s economy will inevitably cool the raw material prices, which will significantly affect our growth.

Moral: we were not shielded from the 2008 crisis, we are not shielded from the looming recession and cannot be shielded for any other crisis, because the global economy is a system where we all affect each other. But a consistent counter-cyclical macroeconomic policy, accompanied by a model of development that reduces dependence on the extractive economy, encouraging industries that are intensive in science, technology and innovation, and promoting the expansion of the domestic market, would make our ship more resistant to global market turbulence.

Pingback: 2013: ¿recesión global? | La caja registradora